Introduction:

Information about what is stock market with types and detailed description about them.

what is stock market:

it is a group of markets and currency exchanges where actions such as buying, selling, and delivering shares of publicly held businesses take place. These shares represent ownership stakes in the companies, and their prices vary based on market conditions, stakeholder sentiment, and company performance.

what is stock market purposes:

Wealth Creation: The main feature of the stock market is to provide companies stock with access to investment. By purchasing/investing in shares of companies, companies are raising funds for growth, research and other process working needs.

What is stock market Liquidity: The stock market offers liquidity, which allows letting stockholders to buy and sell shares rapidly. This feature of stock market attracts more members, attractive market efficiency.

What is stock market Risk Management: Stockholders can expand their portfolios by investing in various types of stocks in different sectors and they can divide their risks.

What is stock market Financial Indicator: Stock market performance is normally viewed as a image of the entire financial environment. Increasing in stock prices are generally indicates to financial growth, whereas, dropping prices gives signal financial downtrend.

What is stock market Price Detection: The price detection is used to calculate consumer and economic surplus. The market helps price detection through the dealings of supply and volume. The prices of shares produce investors’ capabilities regarding a company future performance idea.

The stock market can be divided in various types, mainly based on functionality, structure and geographical location. there are the main types of stock market below:

Through the types we can easily understand what is stock market.

1.Over the Counter (OTC) Market

2.Exchanges

3.Global Stock Markets

4.Primary Stock Market

5.Secondary Stock Market

1.Over the Counter (OTC) Market

The OTC market contains of separate markets where securities are not registered on formal exchanges are traded. It is promoted by a network of traders who deals directly.

Key Features:

Less Regulation: The OTC market has less list requirements it allows to smaller or fresher companies to trade.

Variety of Securities: It contains shares, bonds, derivatives, and foreign exchange.

Higher Risk: Investing in OTC securities can be more risky due to its lower transparency and possibly higher volatility.

Example: Many small-cap companies and startups are trading their stocks in OTC.

2.Exchanges

Stock exchanges are centralized platforms where stocks are listed and traded by providing a controlled situation to confirm fair trading practices.

Types of Exchanges:

Traditional Exchanges: Physical sites for example: New York Stock Exchange (NYSE), where trading happens on the floor.

Electronic Exchanges: Platforms like NASDAQ works completely electronically which helps in faster transactions and higher productivity.

Key Features:

Liquidity: They offer high liquidity and also allowing quick buying and selling of shares.

Regulatory Oversight: Exchanges are deeply structured to protect depositors.

Market Makers: Certain firms act like market makers to confirm sufficient supply and demand for stocks.

Example: The NYSE hosts large established companies, while NASDAQ is known as technology-based firms.

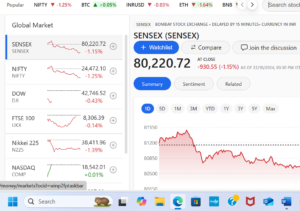

3.Global Stock Markets

Global stock markets involve in exchanges and trading systems across the world in various countries. Stockholders can access international markets providing better different chances.

Key Features:

Regulatory Differences: Every country has its own controlling situation affecting on trading practices and stockholder safeties.

Cross-Border Investments: Depositors can buy shares of foreign companies, financing on global economic growth.

Currency Risks: If peoples are investing in foreign stocks introduces currency variations, impacting returns.

Example: London Stock Exchange (LSE) and the Tokyo Stock Exchange (TSE) are important groups in the global stock market.

4.Primary Market

The primary market is a type of market where new safeties are designed and traded to stockholders for the first time. When a company thinks about to raise capital then it provides shares through Initial Public Offering (IPO).

Key Features:

Underwriting: Savings banks usually back the shares by helping regulate the opening price and certifying that a certain amount of investment is raised.

New Securities Issuance: Companies are creating new stocks to generate capital.

Investor Access: Both individual and institutional investors can purchase shares through the IPO.

Example: A tech startup initiated an IPO for fund its advanced projects shows the primary market.

5.Secondary Market

Once shares are listed in the primary market then they enter the secondary market, where they are traded between investors. This is where the majority of stock trading happens.

Key Features:

Market Exchanges: Transactions held on stock exchanges (like the New York Stock Exchange or NASDAQ) or through the electronic trading systems.

Investor-to-Investor Trading: Shares can buy and sell without the involvement of the issuing company.

Price Dynamics: Prices vary based on investors demand, company performance, and bigger market conditions.

Example: If a investor bought shares of a tech. company from other investor on NASDAQ, that transaction happens in the secondary market.

Most Popular Type of Stock Market: The Secondary Market

Among the various types of stock markets, the secondary market is the most popular and widely utilized. Its significance lies in its high liquidity, accessibility, and the critical role it plays in determining stock prices through trading activity.

How the Secondary Market Works

Stock Exchanges: Trades are executed on stock exchanges, where buyers and sellers come together. The exchange like as a mediator, confirming fair practices and agreement with regulations.

Order Types: Investors place different types of orders to buy or sell stocks. Common order types include market orders (executed immediately at the current market price of stock) and limit orders (executed only at a specific limit price).

Price Fluctuations: Prices in the secondary market are influenced by different factors, counting company performance, market sentiment, financial indicators, and geopolitical events. Investors are immediately reacting on news and events leading to price changes.

Market Makers: In the secondary market, market makers play important role. They simplify trading by providing liquidity in market, buying and selling shares to confirm that investors can execute trades without any kind of delays.

Trading Platforms: With the arrival of technology many investors now use online trading platforms to place trades, display prices, and manage their portfolios. These platforms provide real-time data, charts, and research resources like fundamental details.

Through this blog we know about what is stock market and what is stock market purposes and the various types of stock market.

SOME QUESTIONS RELATED THIS TOPIC:

Ques. What is stock market in simple words?

Ans. Where peoples are buying and selling stocks.

Ques. What is stock market exchange in India?

Ans. Where stocks, bonds and commodities are traded.

Ques. What is stock market exchange platforms in India?

Ans. National stock exchange (NSE), Bombay stock exchange (BSE)

Ques. What is Nifty 50?

Ans. It represents top 50 Indian companies. For more information about nifty 50 companies check this blog – what is nifty 50.